In the current economic context, particularly within the real estate market, implementing a closed real estate credit program focusing on the mid-range and lower-end segments could be a viable solution to balance the interests of all parties involved.

Corporate Bonds in Real Estate Show Signs of Recovery

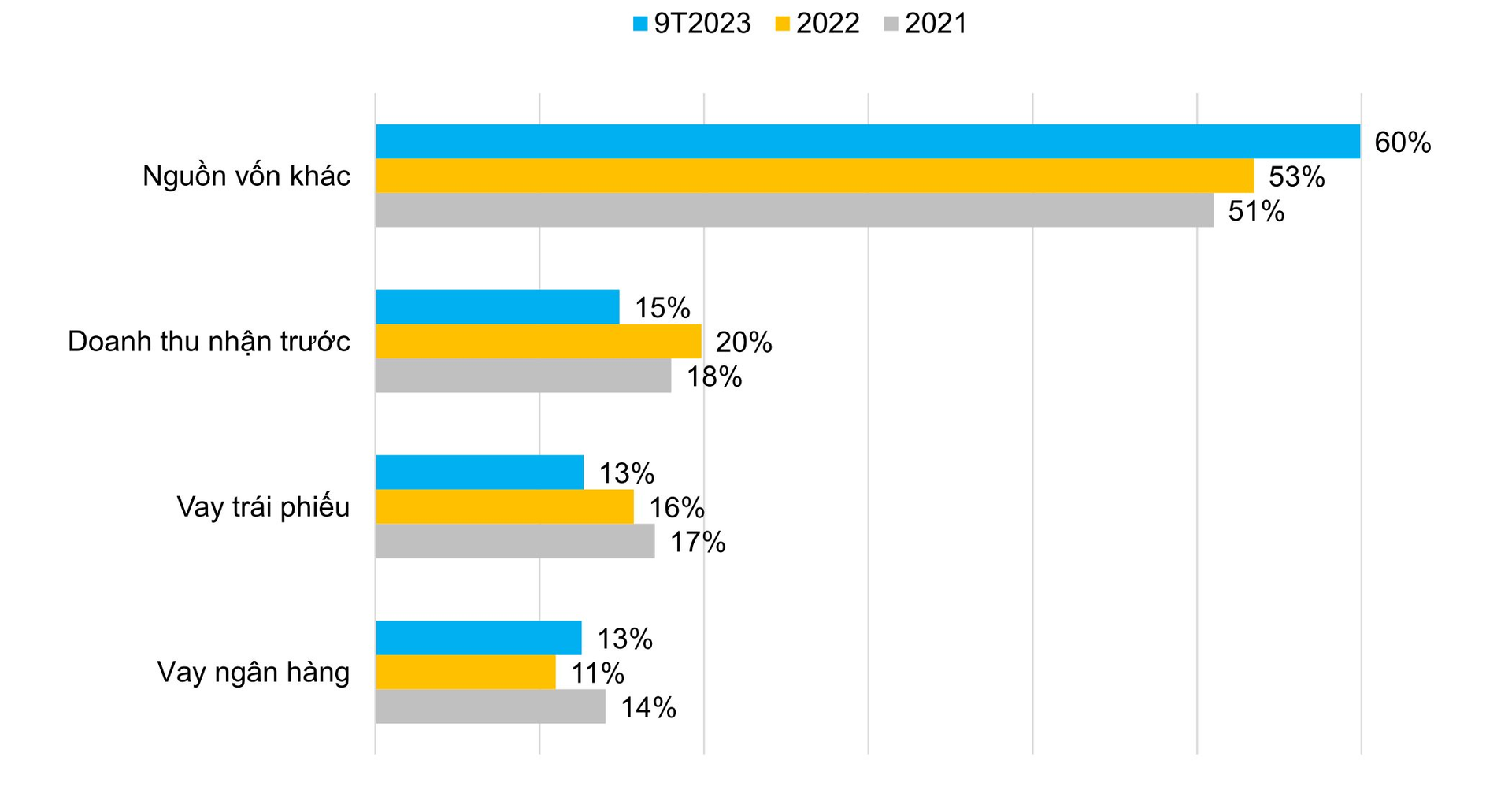

Data from the financial reports of 50 listed residential real estate companies indicate that these enterprises have a total debt of 180.3 trillion VND. When including “other capital sources,” this figure rises to 492.4 trillion VND.

The term “other capital sources” primarily refers to funds obtained through investment cooperation contracts and business cooperation agreements. Circular 06 (postponed by Circular 10) significantly impacts real estate funding, as these “other capital sources” may originate from bank loans.

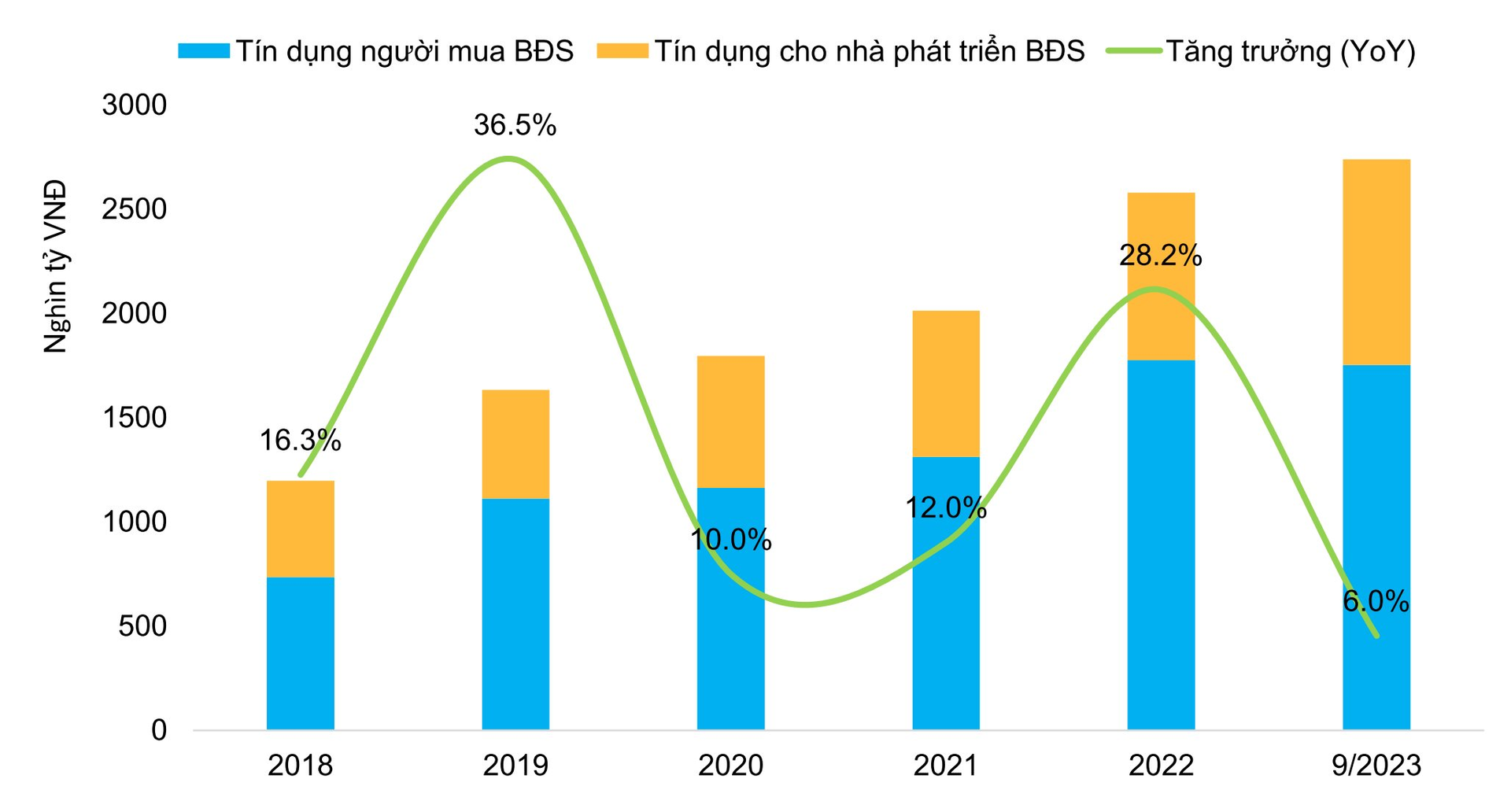

Regarding bank credit for real estate, the period from 2018 to the end of Q3 2023 shows continuous growth, peaking in 2019 with a 36.5% year-over-year increase. In 2020 and 2021, bank credit growth for real estate remained at 10-12% annually.

In 2022, alongside a booming real estate market, bank credit for this sector surged by 28.2% compared to the previous year. Notably, in the first three quarters of 2023, despite several unfavorable market developments, bank credit for real estate maintained a growth rate of 6%, with projections indicating even more positive figures for the entire year.

In the corporate bond market, the real estate sector has shown initial signs of revival. In the first ten months of 2023, 82.9 trillion VND worth of bonds were issued, including 74.8 trillion VND in private placements, with an average coupon rate of 11.92% and an average term of 3.65 years. However, real estate bond interest rates vary significantly, ranging from 6% to 14.5%, depending on the issuer’s credit quality and deal structure.

Currently, there is a disconnect between supply and demand in the real estate corporate bond market. Supply is constrained due to stricter regulations (Decree 65) and companies focusing on debt restructuring (Decree 08). Meanwhile, demand—mainly from banks, non-bank institutions, and individual investors—remains cautious due to legal uncertainties, as many projects lack full legal clearance or require extended time to complete necessary procedures.

Challenges Ahead

The reality shows that all funding channels for the real estate market are facing significant challenges.

For bank credit, the issues include managing credit risk, high credit risks, and substantial legal risks associated with real estate projects.

Regarding the corporate bond channel, recent debt default events have significantly undermined investor confidence in corporate bond products. Additionally, high legal risks associated with projects persist, while foreign capital inflows into real estate remain constrained due to elevated international interest rates.

As for advance payments from buyers, this source is also affected by high real estate prices, while buyers’ incomes are under pressure. Furthermore, although mortgage interest rates have shown a downward trend recently, concerns remain regarding project legal risks and variable interest rate mechanisms.

In the case of business cooperation capital, this channel is restricted due to the State Bank’s policies on controlling credit risks, ensuring loans are used for the intended purposes, and limiting equity contributions and business cooperation (as outlined in Circular 06 amending Circular 39, even though its implementation has been postponed by Circular 10). Additionally, the bond channel is also constrained by limitations on the purposes of bond issuance (as per Decree 65).

It can be said that the credit quality of real estate enterprises is currently declining amidst weakening creditworthiness of property developers. As a result, the real estate market is experiencing significant challenges, with the execution and sales capabilities of developers being notably impacted, as evidenced by the sharp decline in the ratio of pre-sale revenues to inventory levels.

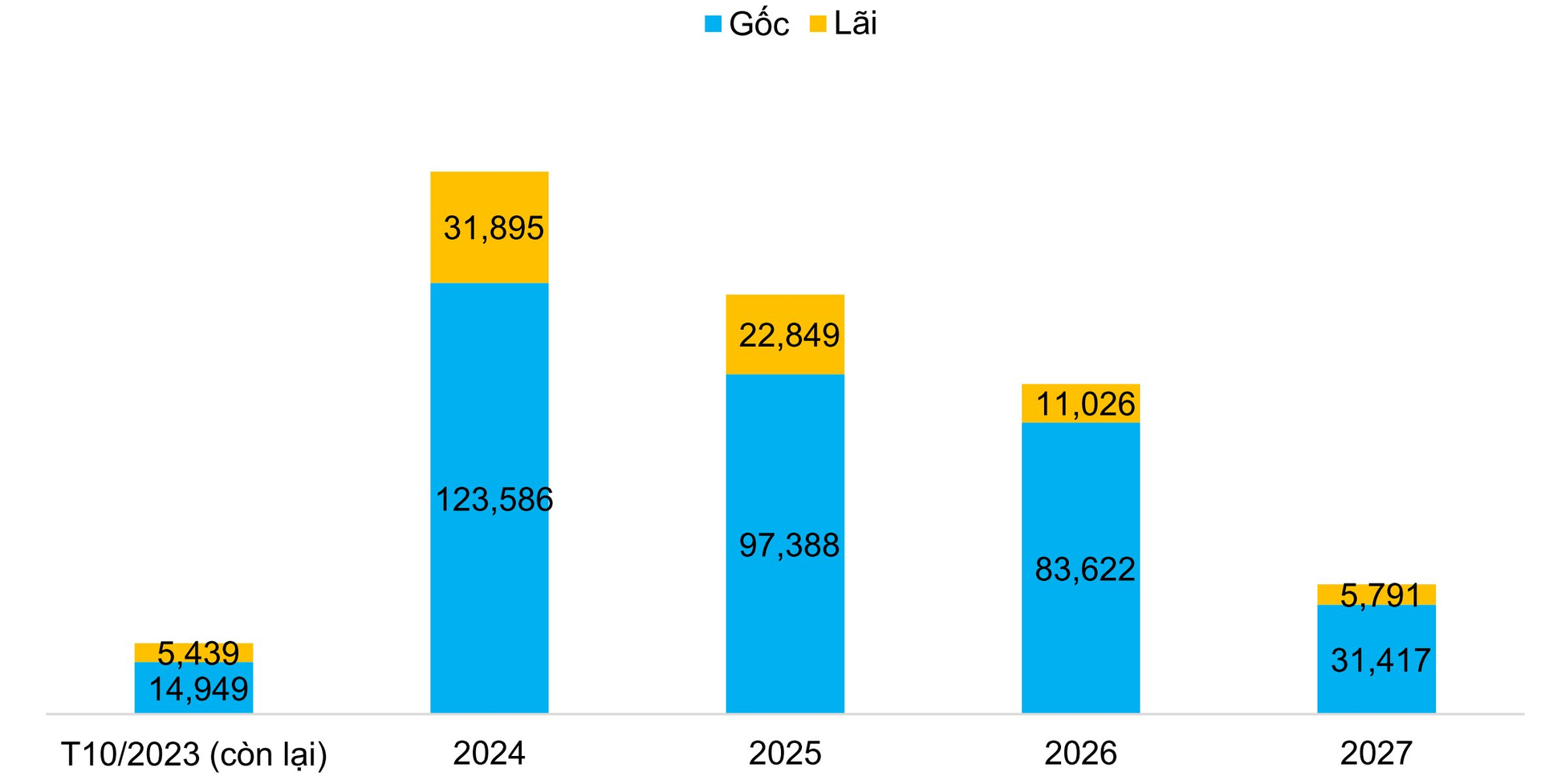

Moreover, the financial health and liquidity of real estate enterprises have weakened, as they face significant pressure to repay both principal and interest while cash flows from business activities are insufficient to meet these obligations.

Notably, while demand for real estate remains high, supply and legal issues are affecting the ability to complete projects. The bankability of projects—critical for securing funding from banks—remains a major challenge.

The outlook for 2024 remains uncertain and heavily dependent on resolving bad debts in corporate bonds and real estate loans. Although real estate business credit has resumed growth (+21.86% for the first nine months of 2023), the scale remains too small to meet the capital needs of the sector. Meanwhile, the pressure on real estate enterprises to repay principal and interest on corporate bonds over the next 12-24 months is significant, with a total amount reaching 275.7 trillion VND.

Solutions to Unblock Credit Funding

Solutions to unlock credit funding for real estate require decisive implementation by all parties, and bondholders may need to accept a reduction in bond value (haircut). The amount reduced would follow a certain ratio, helping to lower debt levels and potentially be converted into equity for bondholders in the issuing enterprises or banks.

In addition to “technical” measures, the most critical step is effectively implementing solutions to address legal issues for projects. This includes projects that have completed land clearance and only require tax obligations to be fulfilled and construction permits to be issued. Other projects should be reviewed to assess the feasibility of paying fees to obtain land use rights certificates (red books). Furthermore, there should be a closed-loop housing credit stimulus program, boosting credit for homebuyers under specific conditions for all parties involved, with a focus on the mid-range and low-end segments.

Transparency in information disclosure must also be improved, and the issuance of bonds must be actively encouraged. In reality, bond issuance activities are gradually recovering. Legally compliant projects with proactive and appropriate transparency in information disclosure still have opportunities to raise capital.

In the short term, the market is looking forward to the amendment of Circular 02 (facilitating credit restructuring) and Decree 08 (extending and deferring corporate bonds), which are expected to have a positive impact on the corporate bond market. However, the spillover effect on bank credit poses a significant risk, particularly for banks with low capital buffers or inadequate bad debt coverage.

The identification of 147 bond issuers who have defaulted on interest/principal payments provides the market with clarity regarding issuers with healthy financial standing. This serves as a foundation and prerequisite for the recovery of corporate bond issuance activities, particularly for real estate enterprises, and the market as a whole.